how to calculate nj taxable wages

Work out your adjusted gross income Total. - New Jersey State Tax.

After a few seconds you will be provided with a full breakdown of the tax you are paying.

. Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages. Here is the formula for calculating taxable wages.

You must report all payments whether in cash benefits or property. Average tax rate 331. Filing 1000000 of earnings will result in 76500 being taxed for FICA purposes.

Related

The withholding tax rates for 2022 reflect graduated rates from 15 to 118. NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. The Unemployment Trust Fund reserve ratio is calculated as follows.

Now to your 403 b. The 118 tax rate applies to individuals with taxable income over 1000000. Total income tax -10707.

Tax Information Sheet Launch New Jersey Income Tax Calculator 1. The New Jersey income tax has seven tax brackets with a maximum marginal income tax of 1075 as of 2022. Opry Mills Breakfast Restaurants.

New Jersey state tax 2320. The fact that your W-2 already reflects. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Exemption Allowance 1000 x. NJ1040 and NJ1040NR requires the total of all state wages to be entered. Like most US States both New York and New Jersey require that you pay State income taxes.

Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Figure out your filing status. Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio.

Marginal tax rate 553. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from. Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for.

In short youll have to file your taxes in both states if you live in NJ and work in NY. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. The wages you report for federal tax purposes may be different.

Because Forms W2 issued in NJ often do not truly represent the allocation of total earnings Drake Tax is unable to. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey. How To Calculate Nj Taxable Wages. Restaurants In Matthews Nc That Deliver.

For federal income tax purposes contributions to a 403 b plan are made on a pre-tax basis. Filing 1000000 of earnings will result in 12600 of your earnings being taxed as. Therefore all withdrawals from a 403 b plan are fully.

How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Taxable Retirement Income. New Jersey allows employers to credit up to 737 in earned tips against an employees wages per hour which can result in a cash wage as low as 263 per hour.

New Jersey does include a few additional items in taxable income that are not included on either your New York or your Federal return. There are two main types of wages. Using our New Jersey Salary Tax Calculator.

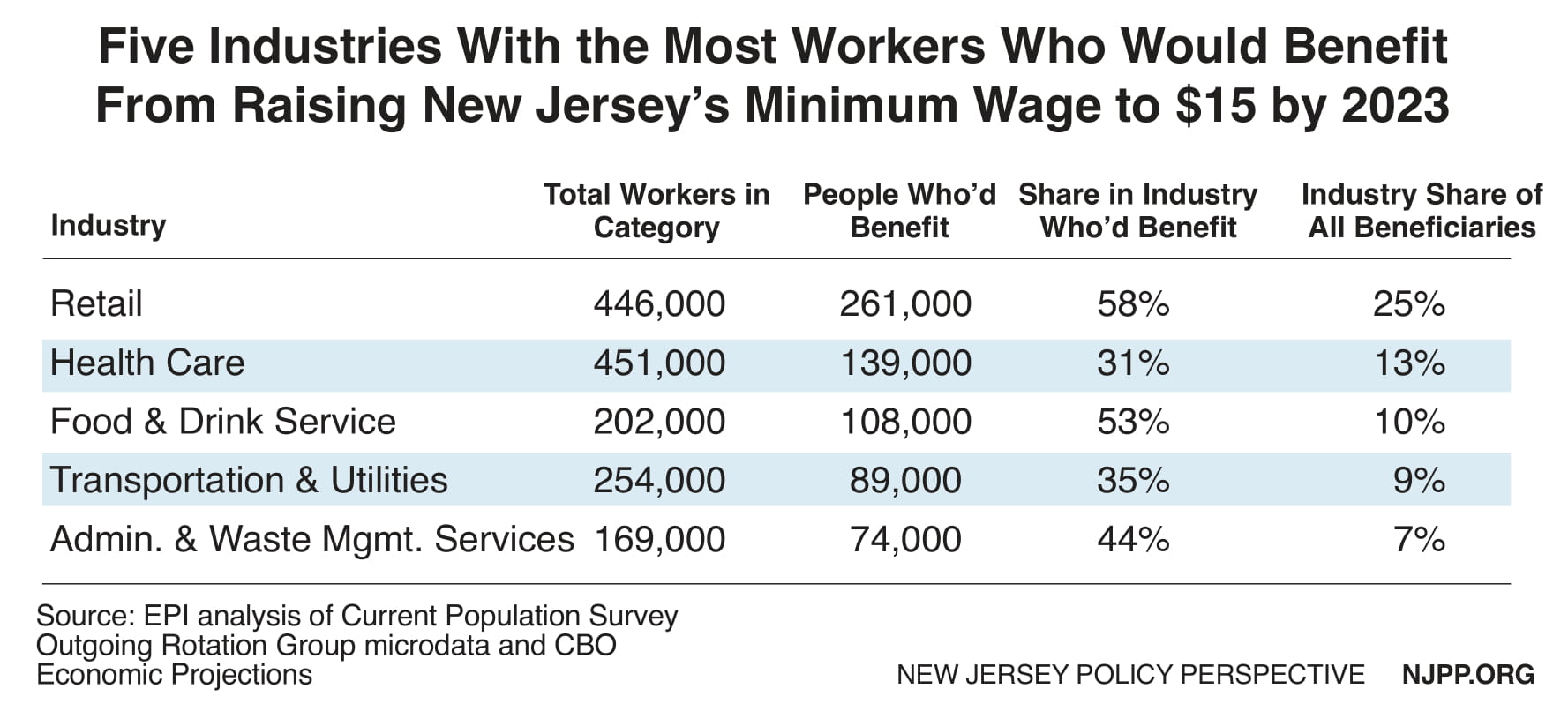

Raising The Minimum Wage To 15 Is Critical To Growing New Jersey S Economy New Jersey Policy Perspective

Solved I Live In Nj But Work In Ny How Do I Enter State

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

Aatrix Nj Wage And Tax Formats

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

Five States Ca Nj Ri Ny Hi Offer Paidleave For Temporary Disability Learn More In A New Report Family Medical Medical Leave Medical

Aatrix Nj Wage And Tax Formats

Solved Remove These Wages I Work In New York Ny And

Solved New Jersey Non Resident Tax Calculating Incorrectl

2020 New Jersey Payroll Tax Rates Abacus Payroll

Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Words Templates

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Aatrix Nj Wage And Tax Formats

New Jersey Nj Tax Rate H R Block

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

Solved Remove These Wages I Work In New York Ny And

Services Provided By New Jersey Payroll Services Llc Templates Sample Resume Resume Template Free